More from News 12

2:17

Sources: Multiple agencies search Manorville location in connection to Gilgo Beach investigation

2:10

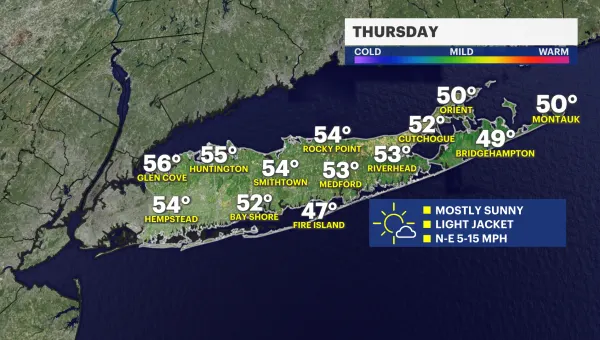

Mostly sunny and cooler Thursday before near seasonal temps return

0:20

Police: Hempstead man killed in 3-car crash on Meadowbrook Parkway

1:53

Shop Mother’s Day Gifts – Exclusive Offers Up to 75% OFF!

2:01

Police: 21-year-old woman fled fatal Massapequa DWI crash in stolen town patrol car

0:31

Islip School District on alert due to threat

0:27

Nassau DA: South Carolina man sold 11 illegal firearms in Freeport

0:21

UBS Arena to host 2024 MTV VMAs in September

0:26

Court adjourned for two suspects in human remains case

0:31

John's Crazy Socks, Guide Dog Foundation unveil world's first tactile Braille socks

1:33

Garden Guide: What is community-supported agriculture?

1:38

What's Cooking: Uncle Giuseppe's Marketplace's Key Lime Pie

0:23

Pitbull announces tour stop at Jones Beach Theater in Wantagh

1:40

Remains of 7 WWII vets found at Freeport funeral home

0:34

DA: Syosset man pleads guilty in DWI crash that killed married couple in Laurel Hollow

1:57

3 families displaced by fast-moving fire at North Amityville home