More from News 12

1:40

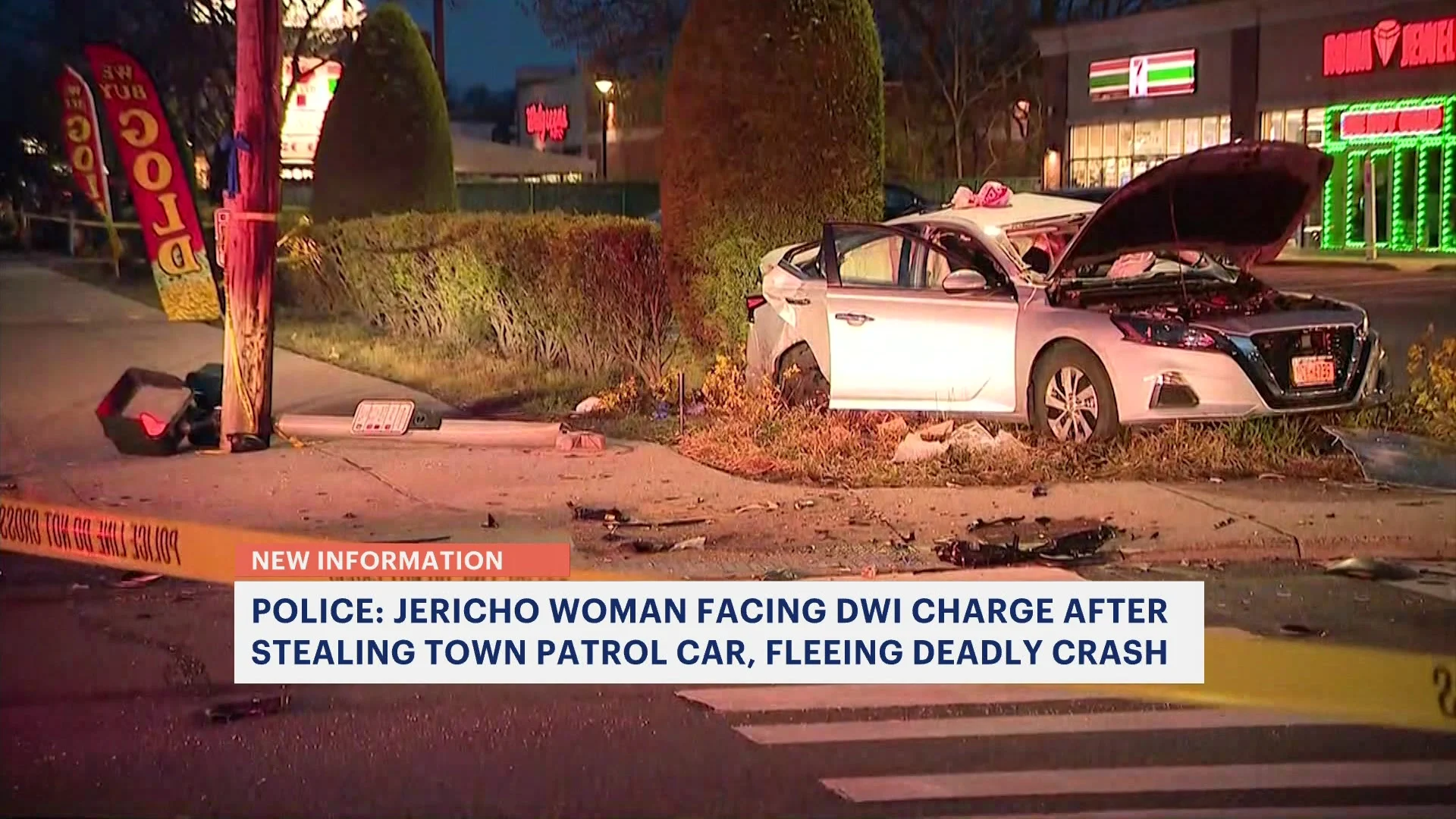

Police: 21-year-old woman fled fatal Massapequa DWI crash in stolen town patrol car

2:25

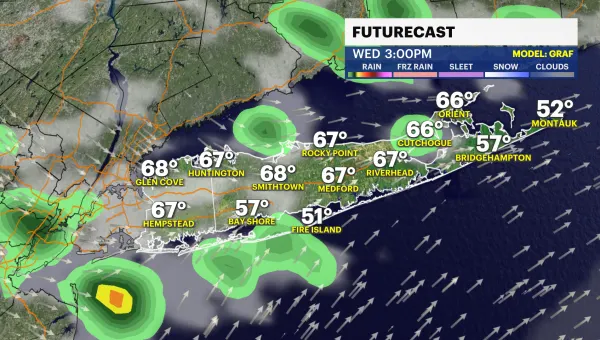

Spotty showers with breezy and warmer conditions today

0:23

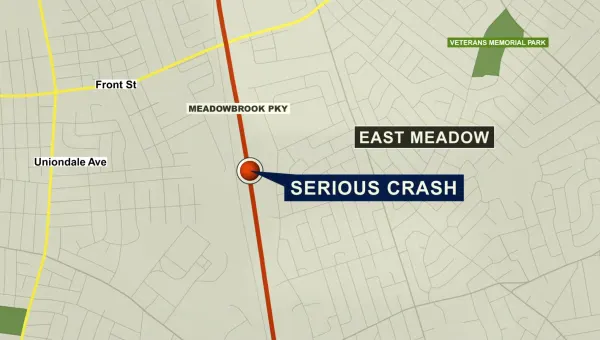

Meadowbrook Parkway reopens following serious crash

0:34

2 suspects in human remains case due in court today

0:31

John's Crazy Socks, Guide Dog Foundation unveil world's first tactile Braille socks

0:23

Pitbull announces tour stop at Jones Beach Theater in Wantagh

1:33

Garden Guide: What is community-supported agriculture?

2:14

Sachem School Board adopts budget piercing tax cap at 4.87%

1:28

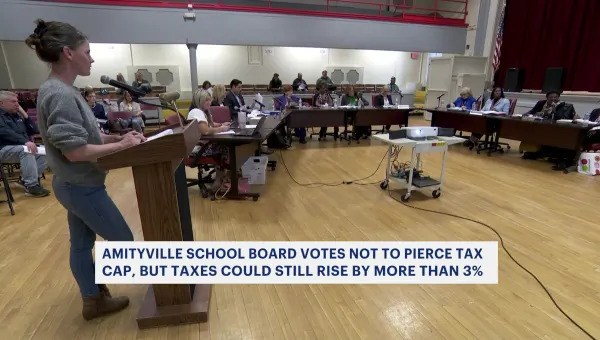

Amityville, Sayville School Boards vote not to pierce tax caps

0:23

Santos bows out of independent run for NY's 1st Congressional District

1:48

Police release photos of vehicle involved in 2022 fatal drive-by shooting in Ronkonkoma in hope of leads

0:23

Police: 5 teens caught on camera trespassing into Patchogue building

1:40

Remains of 7 WWII vets found at Freeport funeral home

0:34

DA: Syosset man pleads guilty in DWI crash that killed married couple in Laurel Hollow

1:57

3 families displaced by fast-moving fire at North Amityville home

0:51

NCC working with food truck vendors to provide food for rest of semester

Is your mom awesome? Long Island tell us why your Mom Rocks!

1:42

Made on Long Island: Nicolock Paving Stones in Lindenhurst

0:48

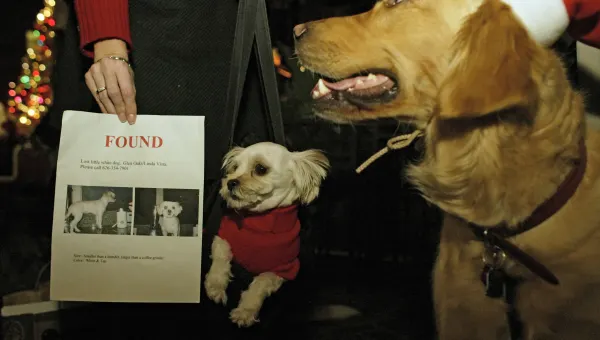

9 steps to take if your ‘fur-ever’ friend goes missing

0:32