More from News 12

1:54

Nassau police arrest accused jewelry thief wanted across the world

2:13

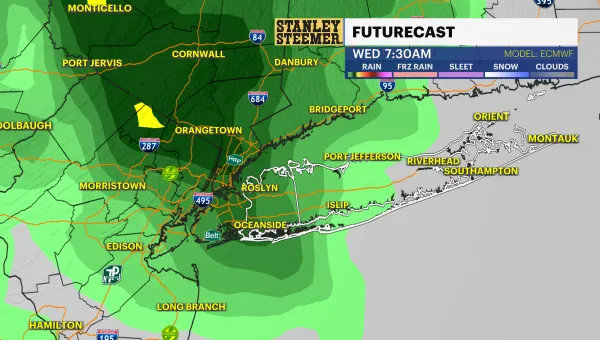

Warm weather and sun for Tuesday, chance for rain later in the week

1:43

Rape charges dismissed against Nassau officer

2:07

LI man mistakenly declared dead by Social Security, leading to severe consequences

1:41

$400 million boost in federal funds coming for security at places of worship

2:06

’Survivor’ exhibit highlights 18 local Holocaust survivors

2:21

Operation Smoke Out: Suffolk police to crack down on underage vape sales

0:22

Police: Driver wanted in fatal New Cassel hit-and-run

0:53

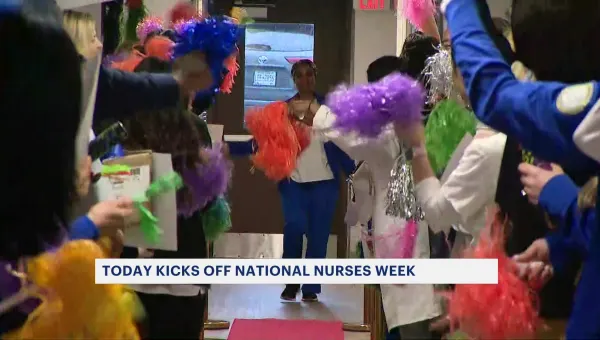

Glen Cove Hospital holds clap-in for nurses to kick off National Nurses Week

1:53

Main Street Long Island: Showcasing the best of Massapequa Park

0:19

Loop Parkway to close overnight for the next two weeks for construction

1:05

Paws & Pals: Dogs up for adoption at Forgotten Friends of Long Island on May 6

Long Island National Teacher Appreciation Week Photos

1:53

Long Island's Jewish communities pause and reflect on Holocaust Remembrance Day

2:14

Teen accused of driving stolen car while high, causing fatal crash in Centereach

1:34

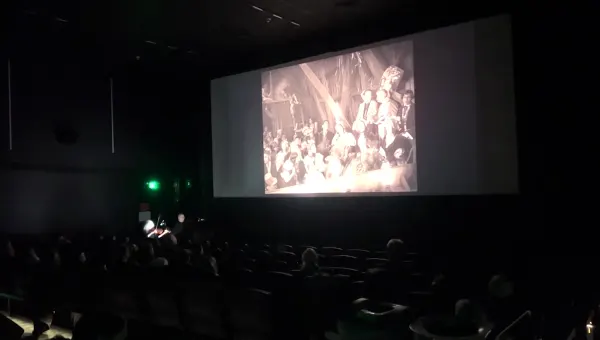

2nd annual Long Island Jewish Film Festival celebrated at Cinema Arts Center in Huntington

0:27

Nassau police: 6 injured in shooting at Westbury home

0:45

Fire breaks out at Plainview storage facility

0:53

Prosecutors: Queens man stole used cooking oil from 16 restaurants

2:15