More from News 12

2:26

Town of Hempstead to hold hearing on Hillcrest of Floral Park apartments

2:54

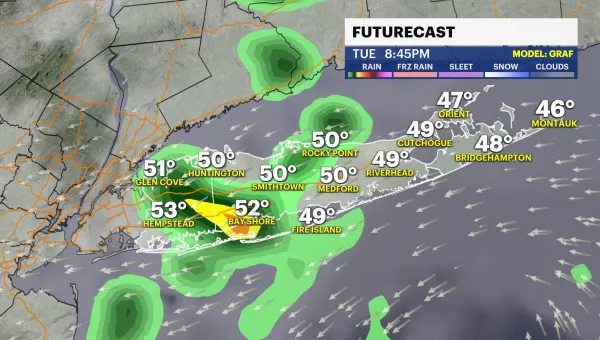

Clouds return with a chance of a shower and highs in the 60s

0:35

Suffolk bakery The Savory Fig recalls baked goods amid state investigation

0:22

Police: Ridge man arrested for selling fake car insurance

2:03

Made on Long Island: UVX Universal Vinyl Extruders in West Babylon

1:49

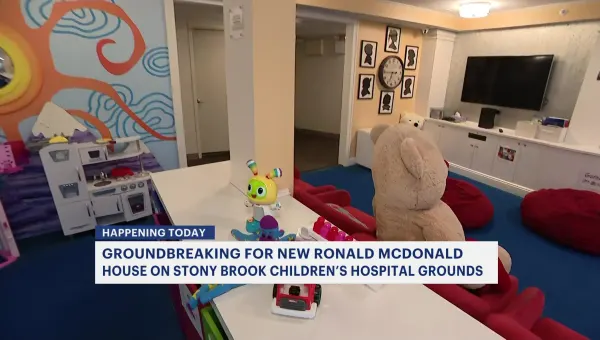

Groundbreaking for new Ronald McDonald House on Stony Brook Children's Hospital grounds

8:55

Guide: Ways to set your child up for financial success

2:18

Police: Driver injured after crashing into hydrant, home in Copiague

2:59

2 defendants in body parts case plead not guilty to second-degree murder charges

2:04

Neighbors voice frustration at 2 developmental proposals in East Setauket

0:56

Bay Shore HS varsity girl's lacrosse team 'Play For Pearl' in memory of 9-year-old

1:15

Suffolk teacher performs Heimlich maneuver on 4th grader choking on candy

1:57

11-month-old who nearly died of fentanyl poisoning saved by first responders

0:49

Students hold pro-Palestinian protest at Adelphi University

1:59

You want the dirt? Thousands of pounds of sod arrives at Eisenhower Park ahead of Cricket World Cup

0:24

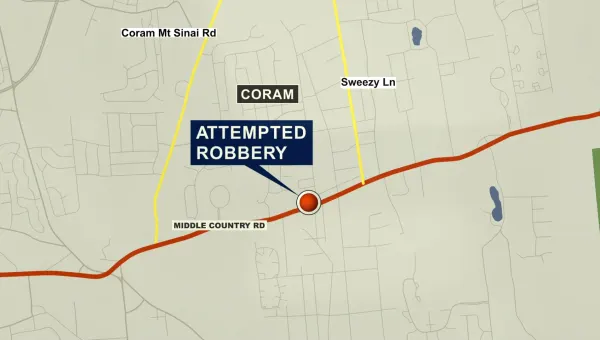

Man arrested for attempted robbery of Coram smoke shop

2:26

Main Street Long Island: Showcasing the best of Port Jefferson

1:52

Paws & Pals: Dogs up for adoption at Paws of War

1:53